Survey Results

We designed our survey to gain comprehensive insights into individual investors' behaviors, preferences, and challenges in the U.S. stock market. We aimed to understand investors' experience levels, decision-making processes, and trading frequencies, as well as their asset allocation strategies and potential barriers to market participation.

The survey also explored the use of online investment tools and sought feedback on desired improvements in these platforms. Additionally, we investigated the impact of employer-granted stock compensation (RSUs and PSUs) on investment decisions and portfolio management.

We also utilized the survey as an opportunity to gauge interest in and concerns about ML-driven investment recommendation tools, particularly a free deep-learning based system. We assessed respondents' risk tolerance levels to provide context for their investment approaches and preferences. This multi-faceted survey allows us to paint a detailed picture of modern retail investors' needs, behaviors, and attitudes towards a tool like Very Intelligent Portfolio.

We received ~80 responses during a survey period of 2 weeks from MIDS community and personal contacts.

Risk Tolerance Profiles

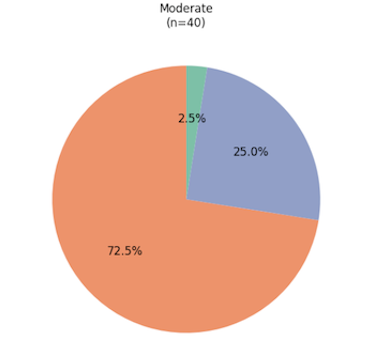

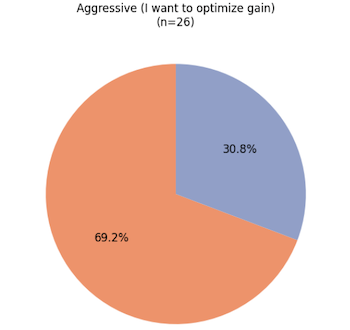

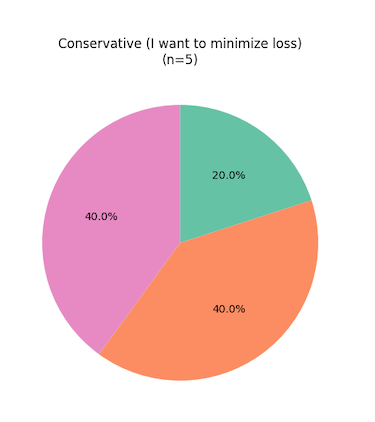

As our primary object at Very Intelligent Portfolio is to help retail customers reduce investment risks, so we surveyed respondents from three different risk tolerance preference groups and identified meaningful attributes from each risk tolerance preference group.

| Risk Tolerance | Characteristics |

|---|---|

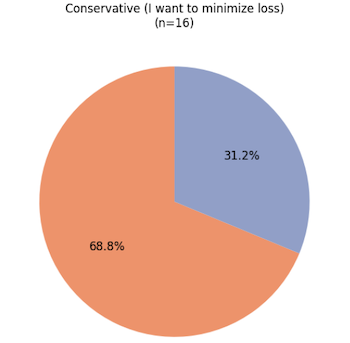

| Conservative | Conservative investors prioritize capital preservation and seek stable, low-risk investments. They typically aim for modest but consistent returns while minimizing potential losses. |

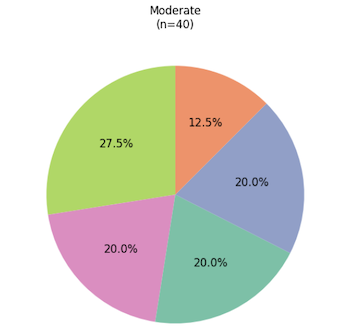

| Moderate | Moderate investors strike a balance between risk and reward. They are comfortable with some market fluctuations and allocate their investments to achieve steady growth over time. |

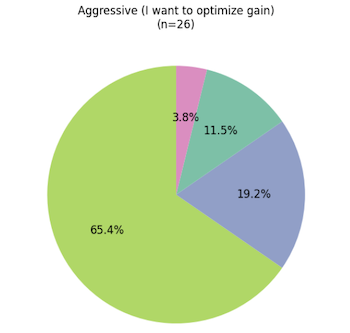

| Aggressive | Aggressive investors are willing to accept higher levels of risk in pursuit of potentially greater returns. They often focus on growth stocks, emerging markets, and other high-volatility investments, and are prepared to weather significant market downturns in the pursuit of long-term capital appreciation. |

Investment Behaviors & Preferences

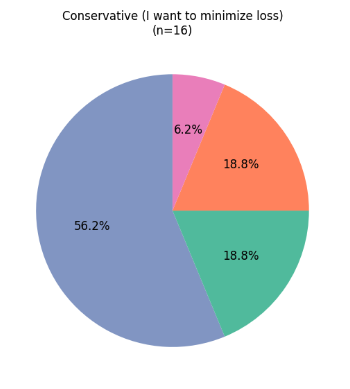

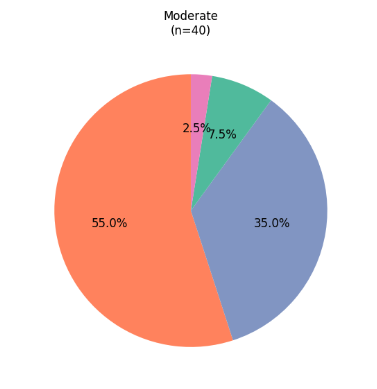

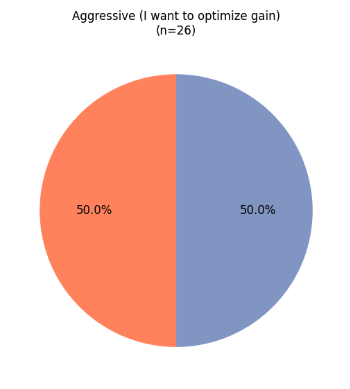

How long have you been investing in the U.S. stock market?

- Half of the respondents have “Moderate” risk tolerance, consistent with our expectation. Surprisingly, more individuals are “Aggressive” than “Conservative”, which could be attributed to our sample (highly educated individuals with financial comfort and being able to afford higher volatility/risk than the general population).

- “Conservative” investors seem to have fewer years of investment experience than those who are more open to higher risks.

How do you make stock investment decisions?

- There is a positive correlation between risk tolerance and using careful research to make stock investment decisions.

- There is a negative correlation between risk tolerance and using word-of-mouth or spontaneous interest to make stock investment decisions.

- These results are consistent with our expectation that aggressive investors tend to be more seasoned in the stock market, allowing them to make more volatile investments while generating higher returns.

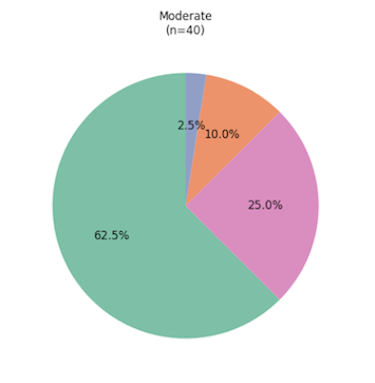

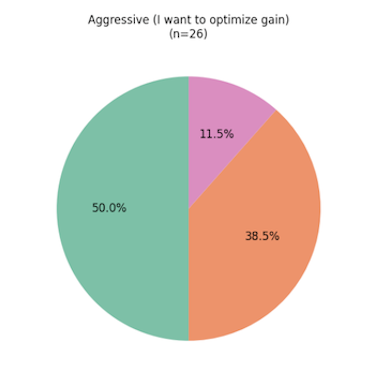

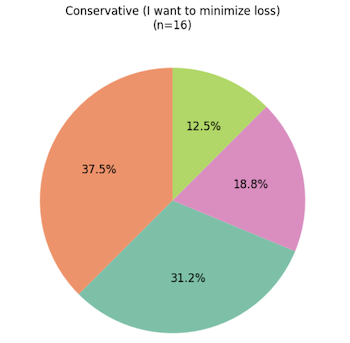

On average, how often do you buy or sell in the U.S. stock market?

- Consist with previous few graphs, “Aggressive” retail investors are also more experienced investors, with more buy or sell at least a few times a month, whereas majority of the “Conservative” investors only participate sporadically.

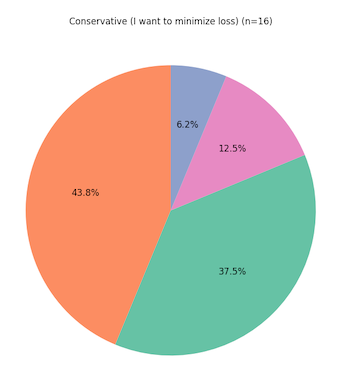

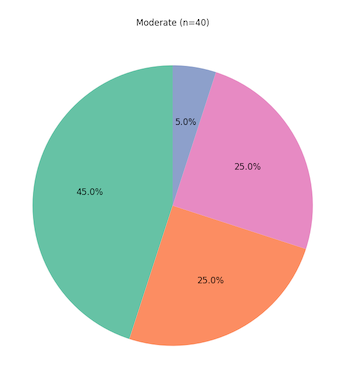

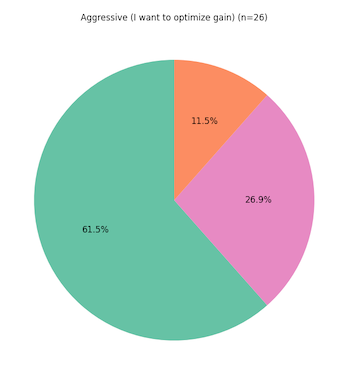

On average, what percentage of your personal assets are in the stock market?

- “Moderate” investors show a balanced distribution among different investment preferences.

- The majority of the “Aggressive” investors invest a large portion of their personal wealth into the stock market, aligning with the aggressive risk profile of using more money to generate more return. None of the “Aggressive” investors invest less than 1% of their personal assets.

- Almost 40% of the “Conservative” investors invest less than 1% of their personal assets with around 10% investing more than 40%, in-line with the conservative risk profile of avoid volatile investment instructions such as the stock market. (Although I think these numbers may change once you remove those who do not invest in the US stock market)

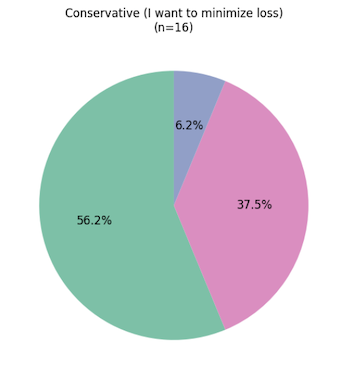

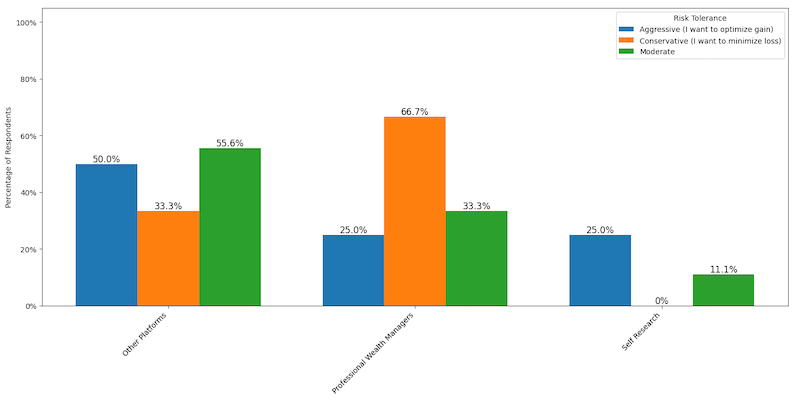

Do you use any online tools to help you make stock investment decisions?

- “Conservative” investors do not rely on on “Self Research” to make decisions, rather, they utilize professional wealth managers more to make investment decisions. This is consistent with the expectations for this group.

- In contract, more than a quarter of the "Aggressive" investors utilize self research, echoing previous findings that "Aggressive" investors may be more experienced.

Stock Compensations

Do you receive RSUs or PSUs as part of your compensation package?

- While most respondents were familar with RSUs/PSUs, a handful respondents were not familar with stock compensations. Most people do not receive RSU/PSUs as part of their compensation package and this is in-line with our expectation.

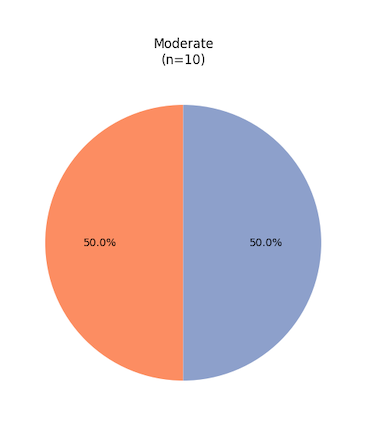

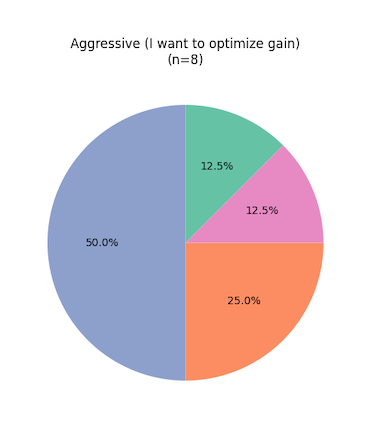

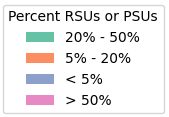

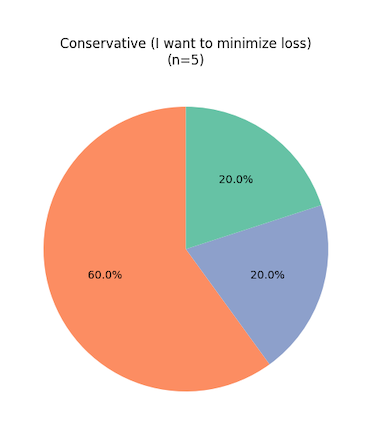

On average, what percent of the stocks you hold are (vested + unvested) RSUs or PSUs granted by your employer(s)?

- For individuals who do invest in the stock market and hold RSUs/PSUs, there appears to be a positive correlation between risk tolerance and level of diversification.

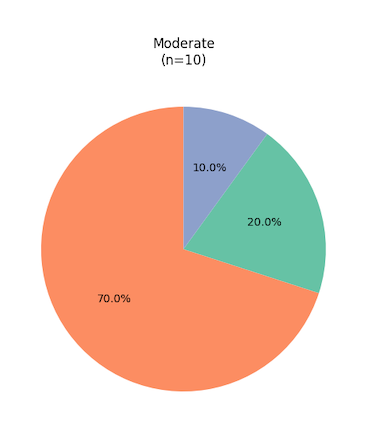

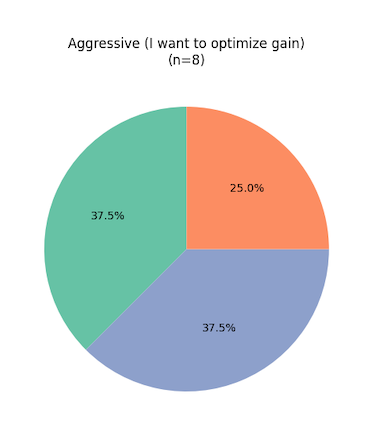

How do you take RSUs or PSUs into account when you make investment decisions?

- For individuals who do invest in the stock market and hold RSUs/PSUs, there appears to be a positive correlation between risk tolerance and level of consideration given to stock compensations when making investment decisions.

- "Aggressive" investors are more likely to carefully consider their stock compensations whereas conservative investors are more likely to disregard stock compensation when making investment decisions.

- Among all investors who did not take stock compensations into consideration, the predominate reason was they did not know they should, where we believe VIP could be a valuable resource for those investors.

Conclusion

That was a lot of information and we hope you found it as interesting as we found it to be! We also surveyed investors on their interest in utilizing VIP to assist with their investmant planning and received overwhelmingly positive interest in VIP!

Based on the survey results, we are confident that there is a market interest and more importantly, there is a market need for VIP. We created three risk profile options for investors to choose from so we can provide the most relevant recommendations base on investor preference.